Banking Case Study

- Frédéric Lé

- Case studies

- July 4, 2021

Table of Contents

Introduction

This banking Case Study is under development. Its purpose is to to illustrate Continuous Architecture practices. It will be mainly used to test the meta-model and provide an example to be used during training sessions.

This work is licensed under the Creative Commons Attribution-ShareAlike 4.0 International License. To view a copy of this license, visit http://creativecommons.org/licenses/by-sa/4.0/ or send a letter to Creative Commons, PO Box 1866, Mountain View, CA 94042, USA.

“As-is” State of RB Bank

RB Bank operates in three countries, France, Germany and Spain.

In France the banks operates under three brands:

- Uni which caters to consumers, small businesses and enterprises through a click and mortar model with 740 branches

- SB which caters to small businesses and their owners through a network of 420 branches mainly operating in the south east part of the country

- Direct which caters to young urban consumers through a mobile banking model.

In Germany the bank operates under the Broker brand and provides Personal Investment services mainly through a direct banking model with a few branches in large cities.

In Spain the bank operates under the Banco 7 brand and caters to consumers and small businesses through a click and mortar model with 860 branches.

Product offerings

The table below describes offered product families for each brand.

| Product Family | Uni | SB | Direct | Broker | Banco 7 |

|---|---|---|---|---|---|

| Checking account | X | X | X | X | X |

| Payment services | X | X | X | X | X |

| Personal credit | X | X | X | ||

| Consumer credit | X | X | X | ||

| Mortgage loans | X | X | X | X | |

| Saving products | X | X | X | ||

| Brokerage services | X | ||||

| Investment services | X | X | X | ||

| Equipment loans | X | X | X | ||

| P&C insurance | X | X | X | X |

Current offerings

UNI small business lending

The small business lending products are not at par with competition and are not tailored to meet specific customer segments’ needs. They consume too much regulatory and economic capital:

- Poor management of impaired loans

- Credit products not designed to optimize capital consumption

The shortcomings of legacy systems and processes have a negative impact on the customer experience. The poor automation level combined with the rework generated by non-quality results into higher costs which contributes to degrade UNI’s cost/income ratio.

Operating model

Each brand is a legal entity that is fully owned by the RB Bank Group and manages its balance sheet and P&L. Financial and regulatory reporting is consolidated at the group level.

Each brand manages its own information system with minimum guidance from the group.

UNI operations

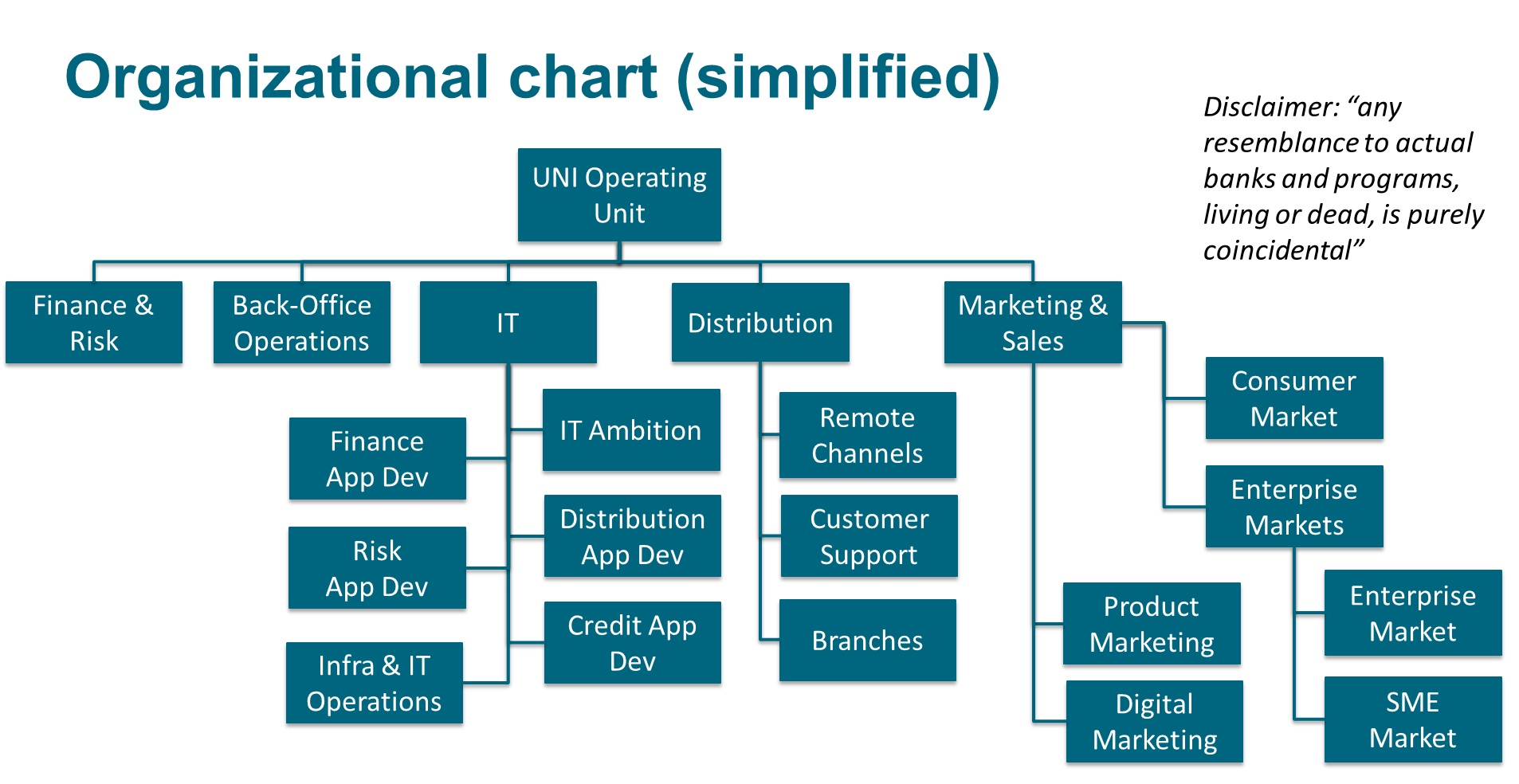

The UNI Operating Unit has adopted a classical retail banking organizational structure :

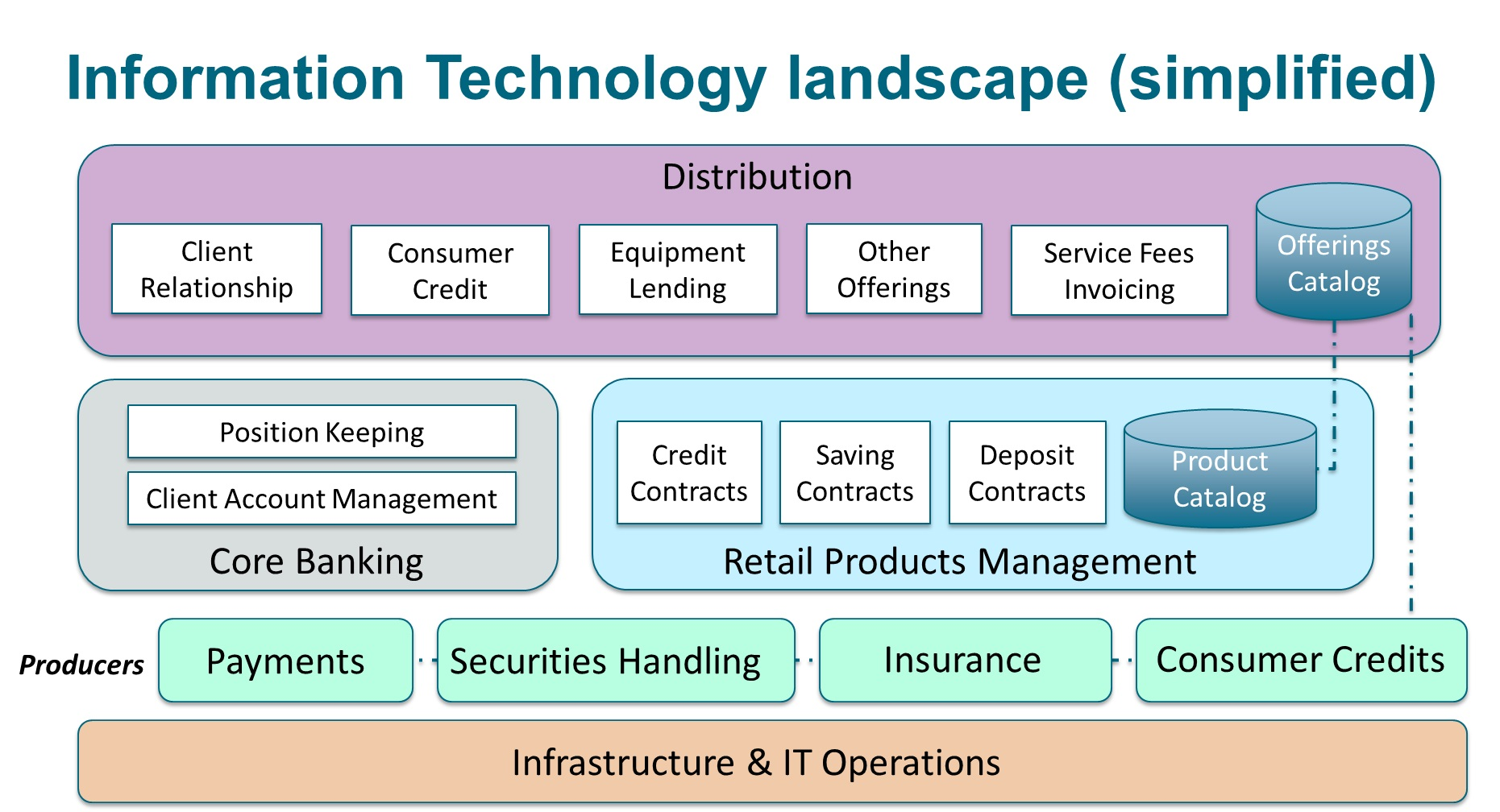

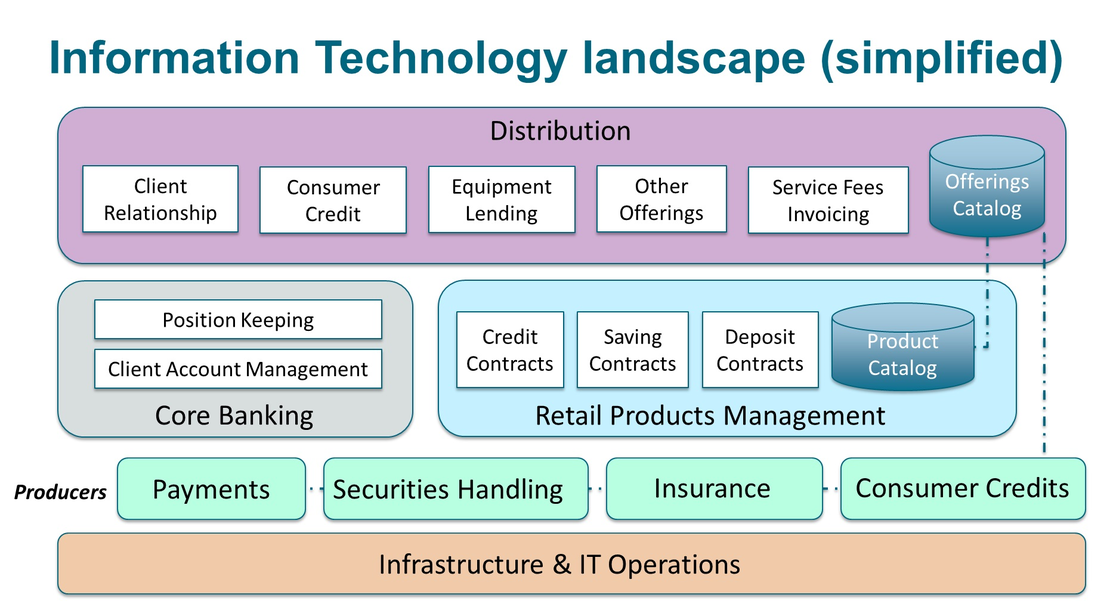

It is supported by an information system that is described in this figure :